This is a follow-up article to: Defining Permanency of Investment.1 As previously noted, the phrase “permanency of investment” appears in the dealership statutes of approximately two-thirds of the 50 U.S. states. In Chapter 218 of the Wisconsin Statutes, in order for an auto manufacturer to add an additional dealership into the market, one of the factors to consider is:

“The permanency of the investment necessarily made and the obligations incurred by existing enfranchised dealers in the performance of their franchise agreement.” 2

“Permanent Investment” is a related term used by courts.3 However, just as with “permanency of investment,” in researching Generally Accepted Accounting Principles (“GAAP”), as well as finance and accounting texts, there is no relevant definition of “permanent investment.”

“Investment", a financial or accounting term, is the outlay of money for income or profit and or the property purchased.4 The assets of a business are the investments of the owners of, and creditors to, that business.

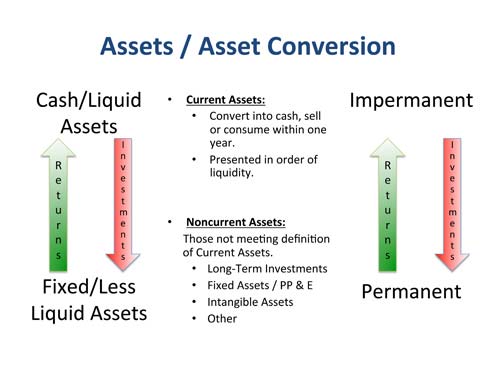

“Permanent” is identified as “continuing or enduring without fundamental or marked change,” 5 or “happening or existing for a long time or for all time in the future.” 6 Permanent is not a financial or accounting term and does not appear in GAAP. However, GAAP defines assets and liabilities relative to their current (less permanent) to non-current (more permanent) nature. Current assets are those most liquid and being reasonably expected to be realized in cash or sold or consumed in a business’ operating cycle (generally 1 year). Cash and other short-term assets are listed first on a business’ balance sheet while long-term, less liquid, or assets of a more permanent nature are listed last.7

Permanency is obviously a scale of permanence and, as previously noted, a scale of liquidity.8 Assets move closer to and further from permanent continuously.

The liquidity of cash is converted to the illiquidity of more permanent investments that are intended to generate returns or profits back in the form of cash. Since the average life expectancy of a multinational corporation, Fortune 500 or its equivalent, is only between 40 and 50 years,9 no asset is permanent. However, one can still view the permanent investment as the long-term, less liquid assets of the business.

The State of California’s New Motor Vehicle Board defined permanent investment as follows:

“The protesting dealer’s permanent investment thus consists of its illiquid assets that cannot easily be liquidated or cannot be liquidated at all or converted to another use.” 10

Examples of permanent investment items would include:

- • Land, Buildings & Improvements

- • Machinery & Equipment

- • Goodwill (business purchase price in excess of net asset value)

- • Other long term assets

However, a recent Wisconsin case included an additional component of permanent investment, working capital:

“It [Zimbrick] has made a permanent investment …, an investment which includes land, buildings and improvements, machinery and equipment, and a minimum working capital requirement.” 11

Working capital is the net current assets less current liabilities, in effect the net balance of the most liquid, least permanent assets of the business.

The reason working capital is included in Zimbrick and not included in the Reliable case is that these two courts are looking at permanent investment through two different lenses. The Wisconsin court views Zimbrick’s permanent investment through a historical lens and the California court views it through a current lens. Both views are proper.

The Historical Lens

The analysis in Zimbrick recognized that the permanent investments made by the dealer were made in the past, as follows:

“ …the [trier of fact] found that substantial evidence showed that Zimbrick’s permanent investment would not be threatened by the new dealership because Zimbrick had already earned sufficient profits to recoup its investments.” 12

In determining the permanency of the investments, it used the historical value of the permanent investments as the denominator in a permanency equation. It used returns made on those investments as the numerator and found that the permanent investment as of the decision date had been converted back into cash.13 In effect, permanent investment was $0.

Some minimum portion of working capital is necessary to run a business. While working capital can fluctuate for example in a seasonal business, the low or minimum level is also sometimes referred to as “permanent working capital.” In all automotive dealership arrangements that I am aware of, a minimum level for every dealership is required and defined by the manufacturer. Because of this, it is simple to quantify and, through the historical lens, also is “permanent.”14

In looking at whether the permanent investments had been converted back into cash, the court recognized that a portion of those returns should be attributed to the minimum working capital maintained over the period analyzed. It did this by including working capital in the denominator of the permanency equation.

The Current Lens

As noted above, the California court only included illiquid assets in its definition of permanent investment. It also looked at these assets currently and assumed the business would cease to exist. With this assumption, working capital becomes cash reasonably immediately and is therefore impermanent. The court put it this way:

“An analysis of permanency of the investment must be done in the context of the protesting dealership’s liquidity….. The liquidity analysis next determines what the protesting dealer would lose if he decided to get out of the business of selling and servicing new and used cars, which a rational dealer would surely do if he truly believed that a new dealership would endanger his investment in the dealership by putting it out of business.” 15

Looking at the permanent investment through the current lens, it is necessary for the court to consider the value of those investments if sold.16 A comparison of the book value of the illiquid assets must be made against their current value because these assets are now assumed to be leaving the business thereby generating a return of cash in the transaction.

At least two alternative calculations can be made in this instance. Assuming the dealership would be liquidated, in effect, shut down because the enfranchised dealer does not believe he could compete in a multi-dealer market, or his franchise point was being terminated, a liquidation value of those permanent assets would be quantified.

Alternatively assuming the dealership were to be sold to another investor willing to run the dealership in the newly proposed multi-dealer market, a fair market value of those assets would be quantified. In both scenarios, the market value would be compared to the book value to determine the loss, if any. In effect, how much of the permanent investment would remain permanent in the form of a loss versus how much of it could be converted back into the impermanency of cash.

Additional Considerations:

It is important to consider that one cannot simply look at the long-lived assets on the dealer’s balance sheet and call that permanent investment for purposes of the dispute under the statutes. Approximately one-fifth of the states’ statutes include “investment necessarily or reasonably made” qualifiers.17 Even without these qualifiers it would be difficult to include non-incremental, unreasonable or unnecessary assets in the calculation. 18 For example, a dealer may have built a dealership on otherwise unproductive and unsalable land. Land may not be included in the permanent investment in this instance. Another dealership may have 100 acres of land on its books but only be using 10 of them for its dealer operations.19 It would appear unreasonable to include all 100 acres in this permanent investment calculation. Similarly, a dealership may maintain 10 times more cash on its books than required in meeting its working capital requirements. While this may benefit the dealership in terms of its flexibility as a business and its floor plan expenses, it would not be reasonable to include this full amount in its permanent investment.

Additional considerations must also be made in regard to the ownership of the permanent investment assets. In the Zimbrick case, many of the fixed assets necessary to operate the franchise were held outside of that franchise.20 Alternatively, in an Ohio case, Chesapeake Ford, those assets held outside the franchise were not to be considered.21

In summary:

1. The “Permanent Investment” in a historical lens permanency of investment analysis must be quantified at a point or points in the business’ past. It is the denominator in an equation made up of the book values (possibly adjusted) of long-term assets at their inception plus minimum working capital. The permanent investment today, is the result of the equation:

returns ÷ historical permanent investment.

2. Alternatively, through the current lens view which assumes the enfranchised dealer would choose to discontinue its dealer operations through liquidation or sale, “permanent investment” today, is the net loss, if any, it would experience in the liquidation or sale of its long-term fixed assets:

valuation value minus current book value.

1'Defining ‘Permanency of Investment’ Law360, New York (Oct. 19, 2011).

2Wis. Stat. § 218.0116(7)(b)2.

3 See for example Zimbrick, Inc. v. State of Wisconsin Division of Hearings and Appeals et al., Case No. 10-

CV-4648 (Apr. 12, 2011); Reliable Pontiac-Cadillac, et al. v. Pontiac Division/GMC Truck Division/Buick

Motors Division, General Motors Corp., Protest Nos. PR-11405-94, PR-1494-95, PR-1495-95 (May 21, 1997)

at 9.

4 See for example http://www.merriam-webster.com/dictionary/investment?show=1&t=1313518705

5 See for example http://www.merriam-webster.com/dictionary/permanent

6 http://www.macmillandictionary.com/dictionary/british/permanent

7 Liabilities are similarly listed.

8 See also Reliable Pontiac-Cadillac, et al. v. Pontiac Division/GMC Truck Division/Buick Motors Division,

General Motors Corp. , Protest Nos. PR-11405-94, PR-1494-95, PR-1495-95 (May 21, 1997) at 9.

9 http://www.businessweek.com/chapter/degeus.htm.

10 Reliable Pontiac-Cadillac, et al. v. Pontiac Division/GMC Truck Division/Buick Motors Division, General Motors Corp. , Protest Nos. PR-11405-94, PR-1494-95, PR-1495-95 (May 21, 1997) at 9.

11 Zimbrick, Inc. v. State of Wisconsin Division of Hearings and Appeals et al., Case No. 10-CV-4648 (Apr. 12, 2011) at 3.

12 Zimbrick, Inc. v. State of Wisconsin Division of Hearings and Appeals et al., Case No. 10-CV-4648 ( Apr. 12, 2011) at 20.

13 Zimbrick, Inc. v. State of Wisconsin Division of Hearings and Appeals et al., Case No. 10-CV-4648 (Apr. 12, 2011) at 20.

14 At least General Motors, Chrysler, Ford, Mercedes Benz, BMW, Volkswagen, Porsche, Saab, Honda and Mazda.

15 Reliable Pontiac-Cadillac, et al. v. Pontiac Division/GMC Truck Division/Buick Motors Division, General Motors Corp., Protest Nos. PR-11405-94, PR-1494-95, PR-1495-95 (May 21, 1997) at 9.

16 See Reliable Pontiac-Cadillac, et al. v. Pontiac Division/GMC Truck Division/Buick Motors Division, General Motors Corp., Protest Nos. PR-11405-94, PR-1494-95, PR-1495-95 (May 21, 1997) at 11-12.

17 Based on our research, it appears that the phrase “permanency of investment” or something very similar to it appears in approximately 34 out of 50 U.S. states. For an example of this language by state see https://berogroup.com/docs/Dealer-Statute-Update.pdf.

18 Financial statement “normalization” is common practice in business valuation.

19 A minimum acreage may also be a requirement under the dealership contract.

20 See Zimbrick Inc. v. American Honda Motor Co. , Inc. Case Nos.: TR-08-0007 and TR-08-039 (August 9, 2010) at 13.

21 Chesapeake Ford, Inc. v. Ohio Motor Vehicle Dealers Bd., 660 N.E.2d 481, 486 (Ohio App. 1995).