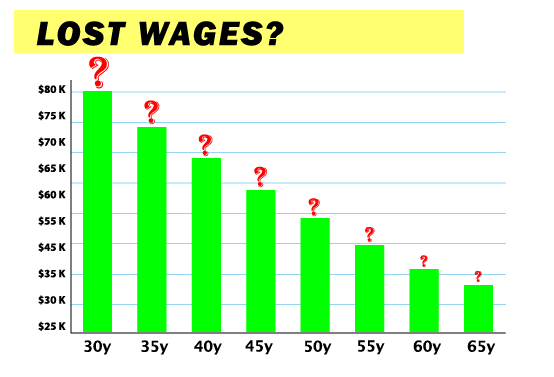

I remember years ago my first wrongful death, lost wage (w-2 employee wage) claim. The economist quantified lost wages through the Social Security Administration’s retirement age and “discounted” them back to the present using the total offset method.

I understood the concept of the total offset method. What bothered me, however, was the idea that wages, through retirement age, were as certain (riskless) as a U.S. Government Bond. 1 While this may have seemed reasonable to my father who, like many or even most of his generation, worked for one company his whole career, it seemed quite unreasonable to me. Of course, it turns out it was. In fact, even my father took early retirement and would not have fit that economist’s model.

In quantifying lost business profits, I, as do most (but, wrongly, not all) always discount the projections back at a rate commensurate with the risk associated with those projections. Sensibly, the present value of the projected future earnings of a start-up business is less than those same projected earnings of an established historically stable enterprise.

In quantifying lost W-2 wages however a safe rate of return is used to discount those amounts back to present value. The injured can take the lumpsum paid, invest in a safe asset such as a government or municipal or highly rated corporate bond index and be virtually guaranteed to achieve what they otherwise would have over their working life.

The key words above were working and life => work-life => worklife expectancy. Worklife expectancy tables address the systematic risk of employment versus unemployment by education attainment and gender.

Having left my first post university public accounting job in 1989 and quickly, that second one for a third in 1990 (horrifying my father) I was initially uneasy with lost w-2 wage calculations being discounted on a risk-free basis. By properly using worklife expectancy tables in my calculations however, I’ve eliminated that unease. 2

NOTE: The opinions and thoughts expressed herein are the opinions of Ronald A.Bero, Jr. They are not necessarily the opinions of The BERO Group.

1 Some experts argue damages should be quantified based on the number of years a worker could have worked, not would have worked. Those experts fail to recognize that they have just interjected a risk factor into the equation. This position has been in decline for years now (see for example: Ireland, Thomas R. 2010. Why Markov Process Worklife Expectancy Tables are Usually Superior to the LPE Method. Journal of Legal Economics 16(2): pp. 95-110. ) Additionally, in that long ago instance, the plaintiff was a business owner. The plaintiff’s expert was confused on many levels.

2 Skoog, Ciecka, Krueger. The Markov Model of Labor Force Activity 2012-17: Extended Tables of Central Tendency, Shape, Percentile Points, and Bootstrap Standard Errors. Journal of Forensic Economics 28(1-2), 2019, (pp. 15-108) 2019 by the National Association of Forensic Economics.

For more information about Ronald A. Bero, Jr.

For more information about Ronald A. Bero, Jr.

and The BERO Group visit us here.